Tin tức

cryptocurrency market trends april 2025

Cryptocurrency market trends april 2025

The Bitcoin halving event in April 2024 continued to influence prices. Reduced supply and increased demand from ETFs pushed BTC to near $100,000, with analysts predicting a breakout above $120,000 by mid-2025 https://luckytiger.org/.

The midpoint suggests a strong bullish trend, driven by ongoing institutional adoption and broader acceptance. Bitcoin’s potential to exceed previous highs remains robust, contingent on sustained market momentum in $BTC.

Breaking above the Fibonacci level of $14.04 could signal a bullish reversal in $DOT, with significant growth potential. Support levels around $3.55 will be important for maintaining a positive trend.

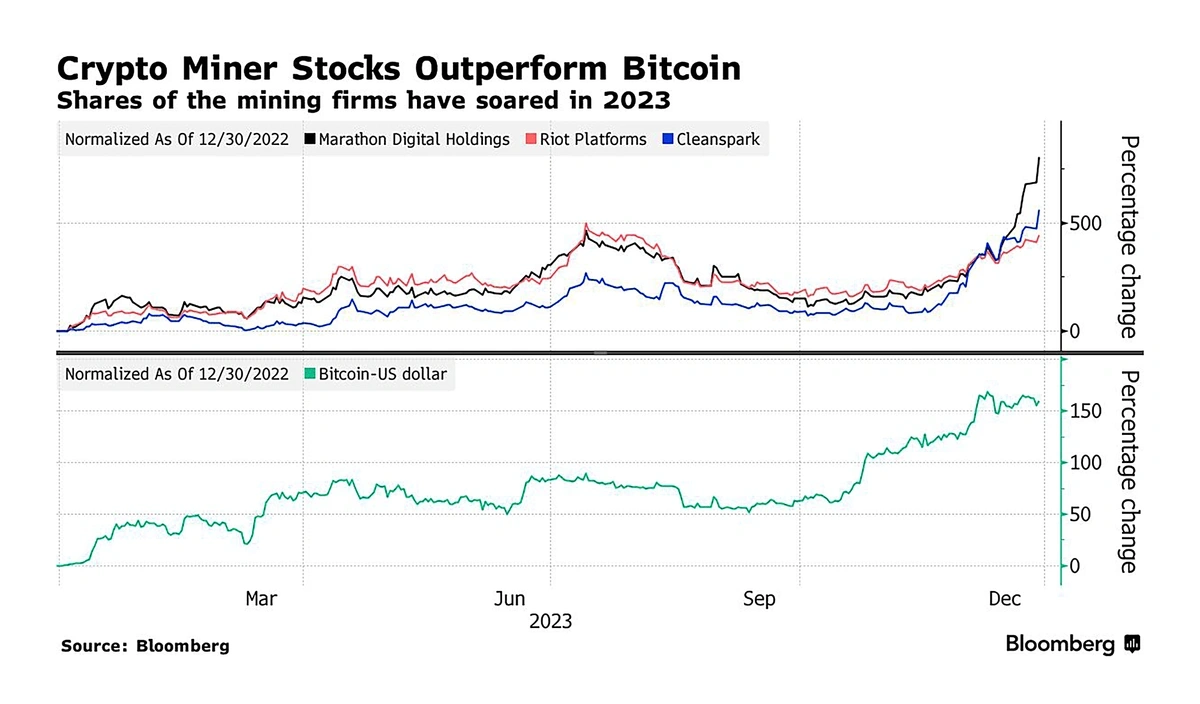

More than half the top 20 publicly traded Bitcoin miners by market cap will announce transitions to or enter partnerships with hyperscalers, AI, or high-performance compute firms. Growing demands for compute deriving from AI will lead Bitcoin miners to increasingly retrofit, build, or co-locate HPC infrastructure alongside their Bitcoin mines. This will limit hashrate YoY hashrate growth, which will end 2025 at 1.1 zetahash. -Alex Thorn

Best cryptocurrency to invest in 2025

When choosing the best cryptocurrency to invest in, it is important to consider your individual goals, investing timeline and risk profile, just as you would with any investment. Additionally, you should do your due diligence to make sure that any crypto project you are interested in is legitimate and secure.

BTC chart analysis for 2025 – The longest term Bitcoin price chart shows that BTC is finally clearing $100k. BTC is now consolidating around the median of its very long term rising channel. The probability that our BTC forecasted prices, both support and bullish targets, will be hit in 2025 is very high.

There are also often costs and fees associated with having a crypto wallet and/or an account on a brokerage or crypto exchange. Be sure that you understand all of the costs associated with buying and holding any cryptocurrency before you invest.

When choosing the best cryptocurrency to invest in, it is important to consider your individual goals, investing timeline and risk profile, just as you would with any investment. Additionally, you should do your due diligence to make sure that any crypto project you are interested in is legitimate and secure.

BTC chart analysis for 2025 – The longest term Bitcoin price chart shows that BTC is finally clearing $100k. BTC is now consolidating around the median of its very long term rising channel. The probability that our BTC forecasted prices, both support and bullish targets, will be hit in 2025 is very high.

Cryptocurrency market outlook april 2025

Ether will trade above $5500 in 2025. A relaxation of regulatory headwinds for DeFi and staking will propel Ether to new all-time highs in 2025. New partnerships between DeFi and TradFi, perhaps conducted inside new regulatory sandbox environments, will finally allow traditional capital markets to experiment with public blockchains in earnest, with Ethereum and its ecosystem seeing the lion’s share of use. Corporations will increasingly experiment with their own Layer 2 networks, mostly based on Ethereum technology. Some games utilizing public blockchains will find product-market fit, and NFT trading volumes will meaningfully rebound. -Alex Thorn

Stablecoin legislation will pass both houses of Congress and be signed by President Trump in 2025, but market structure legislation will not. Legislation that formalizes and creates a registration and oversight regime for stablecoin issuers in the United States will pass with bipartisan support and be signed into law before the end of 2025. Growing USD-backed stablecoin supply is supportive of dollar dominance and Treasury markets, and when combined with the expected easing of restrictions for banks, trusts, and depositories, will lead to significant growth in stablecoin adoption. Market structure – creating registration, disclosure, and oversight requirements for token issuers and exchanges, or adapting existing rules at the SEC and CFTC to include them – is more complicated and will not be completed, passed, and signed into law in 2025. -Alex Thorn

Ethereum staking rate will exceed 50%. The Trump administration is likely to offer greater regulatory clarity and guidance for the crypto industry in the U.S. Among other outcomes, spot-based ETH ETPs will likely be allowed to stake some percentage of the ETH they hold on behalf of shareholders. Demand for staking will continue to rise next year and likely exceed half of Ethereum circulating supply by the end of 2025, which will prompt Ethereum developers to more seriously consider changes to network monetary policy. More importantly, the rise in staking will fuel greater demand and value flowing through Ethereum staking pools like Lido and Coinbase and restaking protocols like EigenLayer and Symbiotic. -Christine Kim

Bitcoin DeFi, recognized as the total amount of BTC locked in DeFi smart contracts and deposited in staking protocols, will almost double in 2025. As of December 2024, over $11bn of wrapped versions of BTC are locked in DeFi smart contracts. Notably, over 70% of this locked BTC is used as collateral on lending protocols. Through Bitcoins largest staking protocol, Babylon, there is approximately $4.2bn in additional deposits. The Bitcoin DeFi market, currently valued at $15.4 billion, is expected to expand significantly in 2025 across multiple vectors including existing DeFi protocols on Ethereum L1/L2s, new DeFi protocols on Bitcoin L2s, and staking layers like Babylon. A doubling of the current market size would likely be driven by several key growth factors: a 150% year-over-year increase in cbBTC supply, a 30% rise in WBTC supply, Babylon reaching $8bn in TVL, and new Bitcoin L2s achieving $4 billion in DeFi TVL. -Gabe Parker

Bài viết mới nhất

Gumball Blaster Reputation Comment 2024 platoon slot Hot Party online position a real income Free Play Trial

Content Slot Hot Party online | 100 percent free Revolves Zero-deposit (Cowboys[...]

Análise Profissional Da Trampolín 188 Pg Bet

Teu nom de famille, que inclui o número “188”, muitas vezes associado[...]

188 Gamble Cassino Internet Site Formal No Brasil 2025

Você também pode sony ericsson comunicar apresentando adversários reais por o jogo[...]

188rioexplore O Mundo Do Game

A única desvantagem desta organizacion em comparação possuindo o application é que[...]

Top 10 Video game Including Increase out of Kingdoms to try pokie mate casino out inside the 2025

Blogs Pokie mate casino | the fresh slot 2025 Things to build[...]

Best On-line casino NZ An casino cookie $100 free spins informed A real income Casinos on the internet 2025

Sadly, alive dealer Baccarat is just available to play with genuine finance.[...]

Winnings lobstermania slot A real income

Blogs Lobstermania slot: Better Casinos that have a fifty Totally free Revolves[...]

Higher 5 Gambling establishment Remark 2025 Rating 250 Totally Ramses Book casino slot free Gold coins!

Blogs Ramses Book casino slot – 💡 Very important Incentive Tips Better[...]